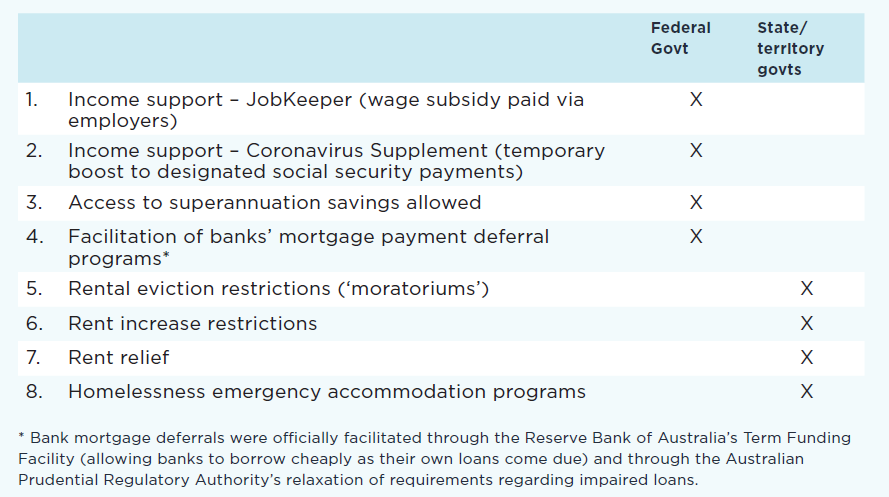

Key pandemic policy innovations relevant to minimising housing market disruption and homelessness in Australia

This table shows the key policy innovations that were introduced in Australia at the start of the COVID-19 pandemic in order to minimise the impact on housing and homelessness. Items 5-8 are the focus of the Poverty and Inequality Partnership report Covid-19: Rental housing and homelessness impacts - an initial analysis

New report shows progress made on homelessness in response to COVID-19 slipping away – tens of thousands face huge rental debts

A new report shows the gains made on reducing homelessness during the pandemic last year are slipping away. It shows less than a third of those assisted with temporary hotel accommodation during the crisis were later transitioned into longer-term affordable housing, mainly due to a shortage of social housing available. At the same time, tens of thousands of people renting across the country now owe mounting rental debts, after having their payments deferred (but not reduced) while eviction moratoriums were in place.

The report - COVID-19 Rental Housing and Homelessness Impacts: an initial analysis – is part of the UNSW Sydney and Australian Council of Social Service’s Poverty and Inequality research partnership.

Australian Council of Social Service CEO, Dr Cassandra Goldie, said:

“During the pandemic, governments did the right thing by increasing income support payments, putting in place eviction moratoriums and providing emergency housing to prevent a sudden surge in homelessness.

“Governments also encouraged landlords to consider rent variations for tenants who had lost income due to COVID-19, but many were unwilling, or agreed only rent deferral rather than rent reduction.

“Now, with emergency tenancy protection and income support being cut back, tens of thousands of people will be facing huge deferred rental debts – putting us at great risk of a worsening homelessness crisis.

Report author, UNSW Sydney Professor Hal Pawson, said:

“Even with the help of increased income support payments and eviction moratoriums last year, our report shows people renting were much harder hit by the pandemic than homeowners. Nationally, renters’ housing costs dropped by only 0.5% on average; mortgage holders, by contrast, typically saw a 5% decline in their housing costs.

“At least a quarter of all private renters lost income during the pandemic, but possibly as few as 8% got a rent variation from their landlord.

“At least 30% of rent variations merely deferred the rent, rather than reduced it. Our report shows there could be at least 75,000 tenants with mounting deferred rent debts across the country.”

James Toomey CEO of Mission Australia, which partnered on the report, said:

“With these huge rental debts mounting and eviction moratoriums ending, many people are deeply worried they will lose their homes and be pushed into homelessness. At the same time, unemployment is above historic norms and the Federal Government has not ruled out cutting the JobSeeker payment back to the brutal old Newstart rate. Income support payments must be set at an adequate rate, and there remains an urgent need for investment in new social and affordable homes if we are to have any hope of addressing rental stress and ending homelessness in Australia.”

Adrian Pisarski, CEO of National Shelter, which also partnered on the report, said:

“State governments acted quickly and on an extraordinary scale to provide emergency accommodation for people who were homeless early in the pandemic, but less than a third of those assisted were later transitioned into longer-term affordable housing.

“People are being left with nowhere to go but a car, someone’s couch or the street. After we saw rough sleeping almost eliminated in several of Australia’s major cities in mid-2020, numbers are once again on the rise. The struggle that state governments have faced in dealing with this situation once again exposes our intensifying shortage of social and affordable housing”

ACOSS CEO Cassandra Goldie concluded:

“Governments, particularly the Federal Government, have the power to prevent this worsening homelessness crisis – to build on their good work during the pandemic and finally get us on track to end homelessness in Australia.

“At the Federal level, the Government can put in place a permanent and adequate level of income support and bolster state social housing construction. A new push to invest in social housing can begin to make good a decade of neglect. It can provide long-term affordable living solutions so that people have a base from which to rebuild their lives, at the same time generating tens of thousands of jobs, supporting our economic recovery from the pandemic.”

More information:

Download the report at: http://povertyandinequality.acoss.org.au/covid-19/housingimpacts/

Changes in employment, hours and wages by percentage from March to June 2020

The spread of COVID-19 and the government-ordered lockdowns to contain it had a sudden and profound impact on employment and earnings in Australia.

This graph shows that, in just the three months from March to May 2020, paid hours worked declined by 10% and employment fell by 6%, whilst wages paid were reduced by 8.3%. In June, there was a modest recovery in paid working hours and wages as lockdowns easied, but unemployment and underemployment continued to rise. The unemployment rate stood at 7.4% in June 2020.

Size of private rental sector, Australia, 1994-2018

This graph shows that, in 2009-10, households renting from a private landlord made up around 23.7% of all households. In 2017-18, they constituted 27.1%.

New report shows who is most impacted by inequality in Australia

A new report by ACOSS and UNSW Sydney shows that, pre-COVID, single people on JobSeeker, even those with some paid work, and single parents on JobSeeker, have been struggling on the lowest rung of the household income scale. Over half are in the lowest 10% of incomes nationally. Half of people on age pensions are in the lowest 20% of incomes nationally, though widespread home ownership among this group provides a significant degree of protection from poverty. The 10% of older people who rent their homes are in a much more financially distressed position.

The report – Inequality in Australia 2020: Part 2, Who is Affected and Why – sets a base-line of data against which to assess the impact that COVID-19 is having on inequality in Australia. It reveals where different groups fit in the income and wealth scales, and the direct causes of inequality from the latest data available, 2017-18.

Professor Carla Treloar, Director of the Social Policy Research Centre, UNSW Sydney, said: “Even before the COVID recession, the highest 20% of households, with average after-tax incomes of $4,166 per week, had almost 6 times the income of the lowest 20%, with $753 per week. When it comes to wealth, inequality is even more stark: the highest 20%, with average wealth of $3.3 million, have 90 times the wealth of the lowest 20%, with just $36,000 on average.

“While we like to think of Australia as the land of a fair go, the reality is that Australia has significant levels of inequality, especially wealth inequality. The latest evidence from other research indicates that the Jobkeeper and Jobseeker Payments actually reduced overall income inequality despite the recession, but as these payments are wound back, the harsh effects of high unemployment and low income support payments for those affected and reductions in paid working hours will be revealed.

“While the number of part-time jobs has recovered to its pre-COVID level, so far only one third of fulltime positions have been restored. This will exacerbate income inequality as government income supports are wound back,” Professor Treloar said.

Australian Council of Social Service CEO Dr Cassandra Goldie said: “The report shows inequality was stark in Australia even before this year, when we have experienced the deepest recession since the 1930s. While the Government did increase income support at the beginning of the crisis, which greatly reduced poverty for a time, it is now threatening to cut income support back to the brutal old Newstart rate.

“People on JobSeeker, including single parents, are now being seriously left behind in the economic recovery, especially with the Government cutting back income support at Christmas time to just $50 a day and threatening to go back to the old, brutal Newstart rate of $40 a day in March.

“We know that unpaid caring work increased during lock downs, especially for women, and this report reveals the impact of unpaid caring work on inequality pre-COVID, with those without full-time work more likely to be in lower income levels.

‘’The prospect that high levels of wealth inequality may become entrenched after the pandemic is also concerning, as high income-earners save more of their income and investment returns and house prices pick up again, ahead of growth in wages,” Dr Goldie said.

The report found:

- The highest 10% of households by wealth owns almost half (46%) of all household wealth, followed by the “middle wealth group” (those in the 60th - 90th wealth percentile) with 38%, leaving the lowest 60% - who are younger and poorer - with just 16% of all wealth. Wealth in the form of shares and other financial investments and investment property is especially skewed towards the highest 10%, who hold two thirds of these assets, including investment property averaging $802,000 in value and shares, business & financial investments worth an average of $1,441,000.

- The Retirement Income Review revealed that the average value of inheritances received by people in the highest 20% by wealth was around $180,000 - twice that of the middle 20% and four times the lowest 20%. Overall superannuation death benefits are projected to rise from $17 billion in 2019 to $130 billion in 2059, in large part due to lax draw-down requirements and excessively generous exemption from tax of the earnings of super funds after a member retires.

Read the report at: https://bit.ly/Inequality2020Part2

Poverty, Property and Place

Download Poverty, Property and Place: A geographic analysis of poverty after housing costs in Australia

View the accompanying maps here: http://povertyandinequality.acoss.org.au/maps/